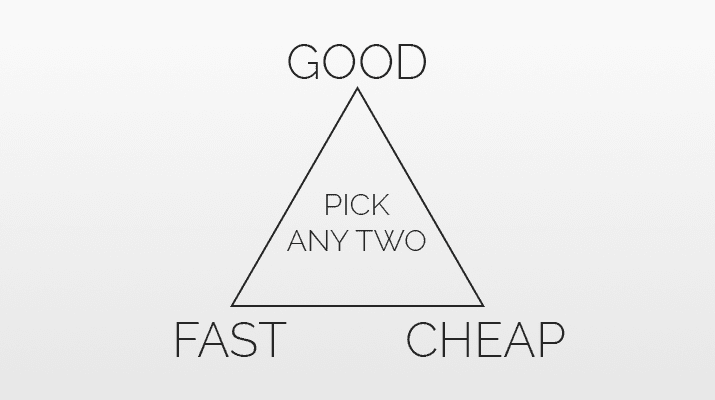

Some would say that you can have two of the following; fast, cheap or quality service but never all three. Well they’re wrong!

With over 15 years’ experience, we have developed our service to suit any kind of business and every individual business owner’s requirements. We pride ourselves in being a credit card facilities supplier who can provide all three! Okay, all three to a greater degree than our competitors.

- Fast: We can sign you up within 24-72 hours, even less depending on the situation.

- Affordable: We have more value for money offerings than the rest.

- Quality: As we are an independent company and not a bank, each of our clients receive the very best personalised service and we are the only provider offering cash back loyalty rewards. Our clients also benefit from complimentary reporting and a dedicated account manager.

Still not convinced? Then this month’s blog article is for you. The WAPPoint team has decided to investigate to what extent business owners are being tricked into thinking that they are receiving the most cost effective merchant service available. Take a look at what we found out below:

Is fast, fast enough?

By working with more than 500 events, exhibitions and festivals every year for the better part of a decade, it has allowed our service teams to check out the “competition” on many occasions and have found that they are more often than not, poorly prepared for the service delivery standards in the exhibitions industry. Exhibitors have a very short window within which they have to make as many sales as possible in order to achieve the financial results required to turn a profit.

Waiting half a day before receiving a card machine could cause an exhibitor to easily lose up to a third of their turnover they would’ve made over a weekend! WAPPoint prides itself in being able to sign you up at a show should your supplier drop you. What’s more, if you switch to us you will be able to benefit from all of the perks that our exhibition clients constantly receive as part of our at show service. We leave backup machines at shows, work with the organisers to ensure that our clients have backup transacting options in case of external technical difficulties.

Are the lowest transaction fees really the best?

South Africans are exceptionally price conscious and often exclusively use price to guide their decision-making process. Service providers know this and may be fooling you into paying more than you should! As a merchant you should be very careful when opting for the lowest transaction fee before considering the total cost of the package that you are signing up for. Many debit and credit card facility suppliers will give you exceptionally low rates only for you to realise, later, that there are minimum turnover requirements or hidden costs. Alternatively, they may require that you move your business bank account to them.

Look at it this way… If you only trade for a few months of the year or do not have high enough revenues on card then you end up paying a lot more for a marginally lower transaction fee percentage. So you’re turning an average of R10 000 on card per month and have signed up for a standard mobile card machine from supplier “X”, this means that you are not making the minimum turnover requirements and will be penalised by them for that. With this penalty and the increased rental you end up paying much more than you would have if you had switched to WAPPoint for a payment pebble where you could save as much as 25% on the total cost of your card machine! Besides that, we don’t charge any minimum turnover fees and our packages offer the flexibility to switch between terminals as your needs change.

Don’t believe us? Click here to ask for a comparative quote and find out how much you could save by switching to us.

What is good service?

We don’t believe in beating around the bush. Things go wrong, especially when technology is involved and we try to best protect our clients for when they do. We leave back up devices on site at all major expos and every WAPPoint client receives an online terminal so they can process transactions when a technical fault occurs. Our 24/7 telephonic support teams are also able to process transactions on the go. Never lose a sale due to a technology malfunction!

Have you asked yourself what your supplier will do for you when things do go wrong? The most important question that you should ask is whether your machine is insured or not. Card machines are incredibly expensive and due to the vast quantities of machines available to pay within the country, people often forget that a brand new traditional credit and debit card machine can cost upwards of R10 000 depending on the exchange rate. This is why we, for the safety and peace-of-mind of our clients, ensure that all WAPPoint machines are insured at all times. We also offer value added support and maintenance packages for clients who prefer to own their machines rather than rent them. Through this package, you can save a lot of unnecessary money spent on card machine rentals in the long run. Feel free to take a look at our older blog posts to find out more about how we are leading the way in the card payments industry!