If your business is only accepting cash and EFT & you feel you don’t need a card machine, then this article will be very interesting to you.

Many business owners think that accepting cash and EFT is good enough but often don’t realise the vast number of clients who chose to shop elsewhere because of this.

In fact, many business owners who start accepting cards soon realise that 2/3 of their customers prefer to pay by card so they instantly see growth in their businesses after getting a card machine.

Perhaps you have done your research in the past and found that the transaction fees are too high and would eat away too much of your profit margin or the monthly rentals and minimum service fees simply make it wasteful to have one. For every business, there is a card acceptance solution to suit your needs and it shouldn’t be a grudge purchase but rather a valuable tool that helps you generate more sales.

Reason 1: A physical card machine is not the only solution, there are more affordable options to accept card payments

Many businesses can operate purely on EFT or cash acceptance but from time to time they come across the odd client who wants to pay by card, usually for a larger amount as the customer might want to put that on a budget facility or earn loyalty rewards or simply cannot afford to pay for something outright.

Solution: Consider a low cost or online payment option

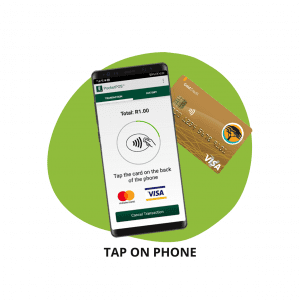

Tap on Phone / Masterpass Scan to Pay – Learn More

- Zero monthly costs

- Lowest transaction fees

- Works via an App on most Android handsets so your cell phone literally becomes your card machine and goes wherever you go.

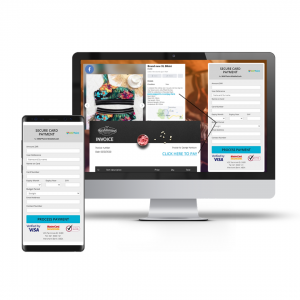

Payment Page – Learn More

- Small monthly fee

- Low transaction fees

- No minimum turnover requirements

- Integrates with your invoices or simply send the link or display the QR Code for customers to pay on the go.

Reason 2: You can buy a card machine and don’t necessarily have to pay excessive monthly rental fees

The monthly fees on a traditional card machine can be insane, especially if you don’t have a frequent turnover or meet the minimum turnover requirement.

Solution: Why rent a card machine if you can buy one?

Purchasing a card machine works out far more cost-effective for a merchant than renting, even though renting a device has its own perks. On average customers who purchase a card machine from us save around R10000 in the first 3 years alone.

| PrintPOS | Rent | Buy |

| Year 1 | =R399x12 = R4788 | R2999+R50pm SIMx12=R3599 |

| Year 2 | =R399x12 = R4788 | R50x12=R600 |

| Year 3 | =R399x12 = R4788 | R50x12=R600 |

| TOTAL | R14364 | R4799 |

When purchasing a device, here are a few tips to consider:

Service Warranty / Ongoing Repairs

- When you purchase a device, ensure that it comes with a service warranty for replacement parts as that is not covered when you have taken ownership of a card machine. Find out if the device is repairable after the warranty to ensure you get the maximum lifespan out of your device.

Keeping Up with the Latest Technology

- Just like mobile phones, you get new devices with better features, every year. Buying a second-hand newer device every 3+ years ensures you pay a good price for your card machines and keep up with the technology at the same time.

The lifespan of the swipe machine

- The average lifespan for a cheaper card machine is about 1 – 2 years vs a robust swipe machine which could last 3 to 6 years if not more. If you purchase a card payment terminal when they’re slightly older in the market, you’ll be sure that it’s been tried and tested and all the faults have been worked out.

Reason 3: You can increase your sales and thus your profit margins if you have a card machine. Also, transaction fees are negotiable, even if you don’t achieve high turnover!

Each time your customer swipes their card, a % of that transaction must go to your merchant service provider. If your markup on your products is not high enough, this % can take away a lot of your profit. Here is how you can overcome this problem:

Challenge your suppliers

- Challenge your merchant service provider by asking them for the best deal they can offer you on your card transaction fees or use our rate calculator so that we can beat or match your current rates. Alternatively, ask your other suppliers if they can come down on their costs to give you a better profit margin on goods/services sold.

Change your package to suit your budget

- Find a card payment solution that allows you to cut your costs by either paying fewer transaction fees or no monthly rental fees

Case Study: Reduce Debtors by getting clients to pay faster and have more cash flow

| Monthly Turnover | Outstanding Debt | Cost of following up or hiring a debt collector | Getting Paid Instantly. Transaction Fees |

| R30 000 | =R300000*25%=R7500 | R7500*30%=R2250 is the amount of revenue lost | R30000*2.65%=R795 |

Case Study: Accepting Card Payment instead of Cash

| Monthly Turnover | Cost of Banking Cash | Cost of Card Payments | |

| R30 000 | +-R30 per deposit+R2 per R100 R30000/100=300xR2=R600+1 deposit per week = R720+ Petrol + Time wasted going to the bank. Of course, there is also the risk of carrying cash and, in this calculation, we used a weekly deposit example but you may need to go to the bank more often than weekly so the fees can really add up. |

R30000*2.65%=R795 |

Case Study: Customer Convenience which can encourage impulsive buying or larger purchases

| Monthly Turnover | Profit Before Card Machine | Monthly Turnover After Card Machine | Profit After Card Machine |

| R30 000 | R30000-22%(Cost of sale)= R 23400 |

R30 000+20% Growth=R36000 | R36000-22% (Cost of Sale)= R7920 Card Fee=R36000*2.65%=R 954 Total remaining profit: R36000-R7920-R954=R 27126 Just by having a card machine u make R 3726 more profit! |

Reason 4: You don’t have to enter a binding long-term agreement or make a lifetime commitment. Suspend your terminal when Lockdowns / business changes affect you.

With some merchant suppliers, you need to enter into a contract for a year or longer in order to make use of their services. The problem with this is, if you are unhappy with their fees or services later or you need to change your card processing options, you are in a binding contract and it’s not easy to get out of that. Here are alternatives:

Solution: Purchase your device or choose a provider that offers month to month contracts

Rather buy your card machine than go into a long-term rental basis with the supplier

Many merchant service providers tie their merchants into 12-24 month contracts.

- Did you know: WAPPoint works on a month-to-month contract basis. If in a binding contract, speak to us and we will advise you on how to switch to us

Solution: Choose a service provider that offers flexibility for you to change products as your business needs change

- Find a provider that offers both rental and purchase deals and a wide variety of payment solutions. That way, you can easily chop and change as your business evolves. If your business suffers due to different lockdown levels, you can also cancel or suspend services when you need to and pick up again when the wave is over.

QUICK TIP: Test the service -Call the helpline before signing up

Before entering into a contract, test the technical support by phoning their helpline. It’s always good to know what the process and waiting period are for someone to assist you when you need it the most. How long will they take to facilitate a swap out? Can they offer a free backup solution that can be used while you wait for a repair? Are the call center hours the same as your operating hours? A broken card machine can cost you thousands in lost revenues so service is a necessity and must be considered when choosing a merchant service provider.